Administration Pushes Toward 100 Percent U.S.-Made EV Chargers in Federal Funding Shift

- Topics :

- Energy

FERC’s 2025 Energy Infrastructure Update: 26 GW of New Capacity Is Rewriting America’s Power Mix

Published November 10, 2025

The U.S. energy landscape is undergoing one of its fastest transitions in decades. Between January and August 2025, nearly 26 gigawatts (GW) of new electric generating capacity came online, according to the Federal Energy Regulatory Commission’s (FERC) latest Energy Infrastructure Update. That figure represents a significant jump from the roughly 23 GW installed over the same period in 2024. The report underscores how solar and wind continue to dominate the country’s capacity growth, while natural gas remains an essential source of grid stability. Together, these trends reveal how technology, policy, and market forces are reshaping the generation mix across the United States.

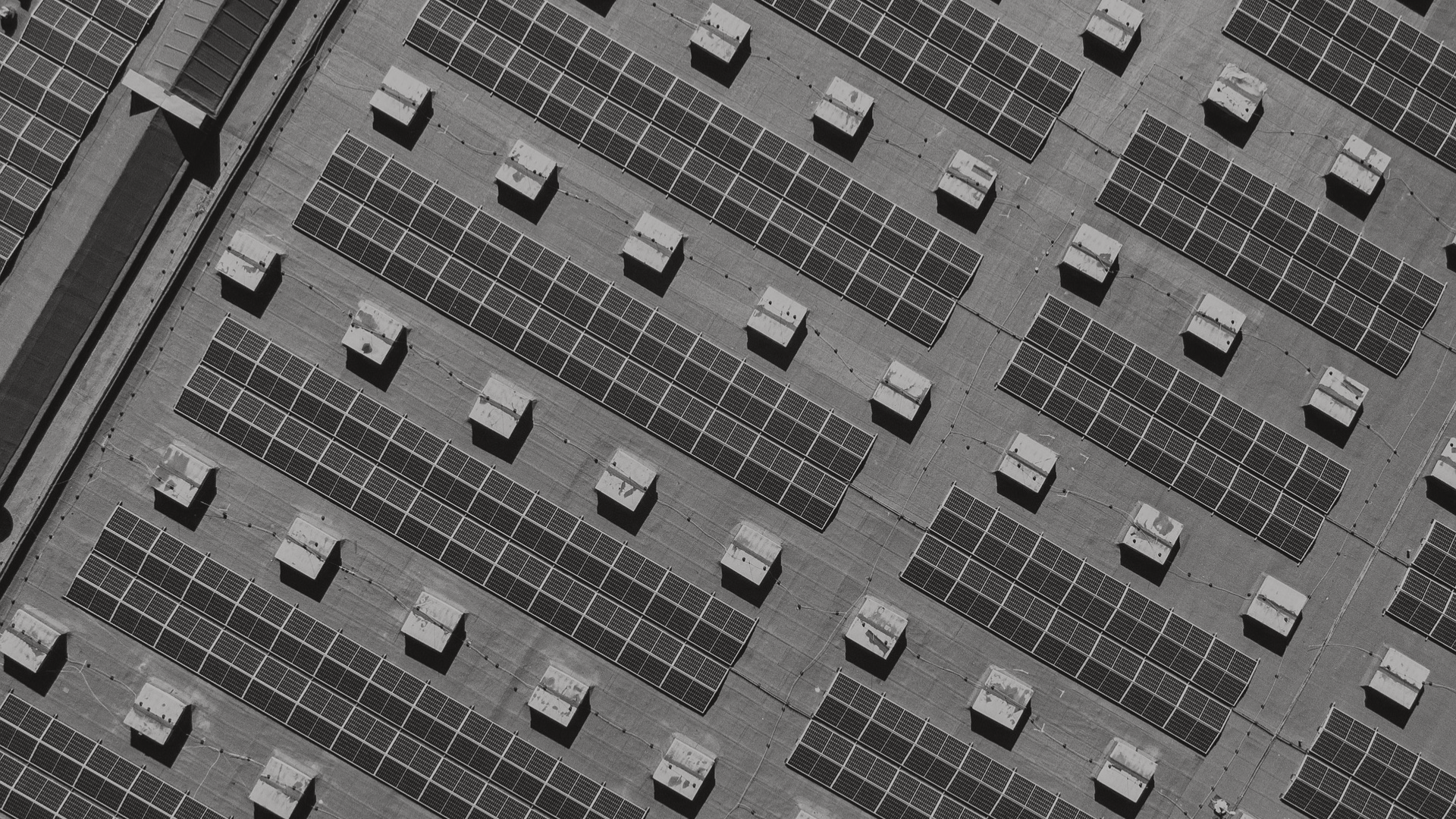

Solar Leads the Surge in New Generation

FERC’s August 2025 update confirms that solar power continues to be the primary driver of new capacity. A total of 19.09 GW of solar has been added across 505 new units so far this year, accounting for roughly three-quarters of all new generating capacity. The pace of solar installations reflects both the declining cost of photovoltaic modules and the continuing impact of the Inflation Reduction Act, which extended key tax credits and spurred private investment. Large-scale projects such as Hecate Energy’s 517-megawatt (MW) Outpost Solar and Storage project in Webb County, Texas, and the 280-MW Gibson Solar project in Indiana highlight how utility-scale developers are expanding into new regions beyond the traditional solar hubs of California and Arizona. These projects also demonstrate the increasing importance of hybrid installations that combine solar with battery storage to enhance grid flexibility.

Year-over-year comparisons show the growing maturity of the solar sector. In 2024, solar capacity additions reached approximately 15 GW over the same timeframe. The jump to 19 GW in 2025 indicates both stronger supply chains and streamlined interconnection processes in several Independent System Operator (ISO) territories. Analysts expect continued acceleration through 2028 as permitting reforms and federal funding for transmission improvements begin to take effect.

Wind Power Steadily Expands Its Footprint

Wind energy continues to play a vital role in diversifying America’s renewable portfolio. Between January and August 2025, the U.S. added 3.78 GW of new wind capacity from 27 projects, a notable increase from 2.78 GW during the same period in 2024. Texas remains the leading state for wind development, with expansions such as the 254-MW addition at the Roadrunner Crossing Wind Farm in Eastland County. Other states, including Oklahoma, Iowa, and Illinois, are benefiting from modern turbine technologies that reduce maintenance costs and increase capacity factors.

While supply chain disruptions and local permitting debates have slowed some projects, the steady growth of wind power illustrates ongoing confidence among developers and investors. Wind generation complements solar production patterns, providing energy during nighttime and winter months when solar output is lower. As a result, utilities are increasingly integrating wind and solar procurement to stabilize renewable portfolios and improve resource adequacy.

Natural Gas: Small but Strategic

Despite renewables capturing most new investment, natural gas continues to play a strategic role in ensuring reliability and meeting peak demand. FERC data show that 3.10 GW of gas-fired capacity has been added from 61 new units in 2025. While this represents a smaller share of total capacity growth, it remains essential for balancing variable renewable generation.

Several key projects demonstrate how gas generation is being repositioned rather than expanded. The A.B. Brown expansion project in Indiana added 248 MW, the Pioneer Generation Station in North Dakota contributed 245 MW, and the Maxwell Peaker Plant in Texas added 188 MW. These peaking and mid-merit facilities are designed to respond quickly during periods of low renewable output or high electricity demand. The focus on smaller, flexible gas units rather than large baseload plants signals a shift in how utilities are planning for reliability within a decarbonizing grid.

Forward Outlook: 136 GW in the Pipeline

Looking ahead, FERC’s projections show a remarkable 136 GW of “high probability” additions through August 2028. Nearly 84 percent of this capacity is expected to come from renewable sources, led by solar and followed by wind. Natural gas projects make up about 15 percent, with coal, oil, and nuclear power continuing to decline in share. These figures reinforce that renewables are not only dominating current installations but also shaping the long-term investment landscape.

The Sun Day Campaign, which tracks federal energy data, notes that FERC’s outlook suggests continued expansion of renewable energy’s role in the national generation mix. Executive Director Ken Bossong stated that despite political uncertainty and policy shifts, solar and wind are adding more generating capacity than fossil fuels and nuclear power combined. The challenge now is less about generation deployment and more about integrating this capacity into an aging transmission system. Grid congestion, interconnection queues, and the need for expanded storage are becoming defining issues for planners and regulators.

Conclusion

FERC’s August 2025 Energy Infrastructure Update captures a pivotal moment for the U.S. power sector. Solar continues to surge ahead, wind maintains steady progress, and gas remains a stabilizing force in a rapidly evolving grid. With 136 GW of likely additions through 2028, the country is entering a new phase of renewable maturity. The next frontier lies in ensuring that transmission infrastructure, data systems, and market mechanisms evolve quickly enough to keep pace with generation growth. America’s energy transition is accelerating, and the data from FERC make clear that this transformation is both broad-based and resilient.

Reference

- Federal Energy Regulatory Commission: Energy Infrastructure Update – August 2025

- Utility Dive: US installed nearly 26 GW of new generating capacity from January to August