The Strategic Advantages Big Companies Have

Large corporations possess a set of structural advantages that position them well to invest in DAC despite the risks. Access to capital is the most obvious: major corporations can allocate hundreds of millions to climate technology without endangering their core operations.

These firms also derive brand and ESG value from being early movers. High-profile DAC investments signal leadership in climate responsibility, enhancing reputation among stakeholders, customers, and investors.

Importantly, large companies have a higher risk tolerance. They can absorb potential technological setbacks or delays without jeopardizing their financial stability. Furthermore, they benefit from strong partnership networks, which allow them to collaborate with technology developers, governments, and financiers to de-risk projects.

Signs That the Playing Field May Expand

Despite current barriers, several trends suggest DAC could become more accessible to smaller organizations in the coming decade. Policy support is a major driver: in the U.S., the expanded 45Q tax credit offers up to $180 per ton for CO₂ captured and stored, while the EU is developing frameworks to certify and trade carbon removal credits.

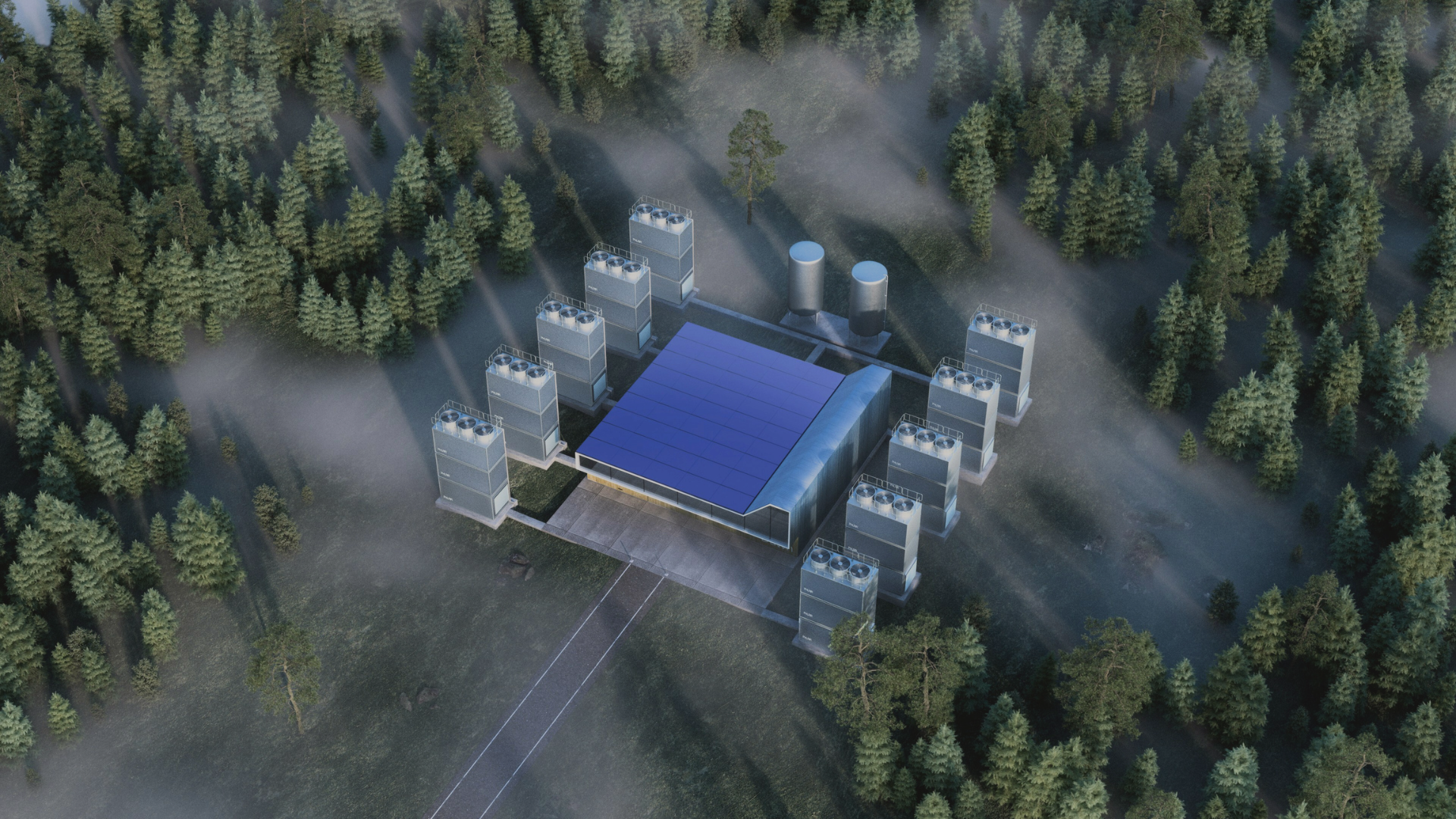

Technological innovation is also reshaping the economics. Modular DAC units, which are smaller and standardized systems, allow for incremental scaling and faster learning curves. Advances in sorbent materials and process optimization promise lower operational costs.

New aggregation models are emerging, enabling smaller buyers to pool funds to purchase DAC credits collectively. Innovative financing mechanisms, such as blended finance and dedicated climate funds, are helping bridge the gap for non-mega-corporates. Finally, regional DAC hubs, where capture facilities share infrastructure for CO₂ transport and storage, could significantly reduce individual project costs.